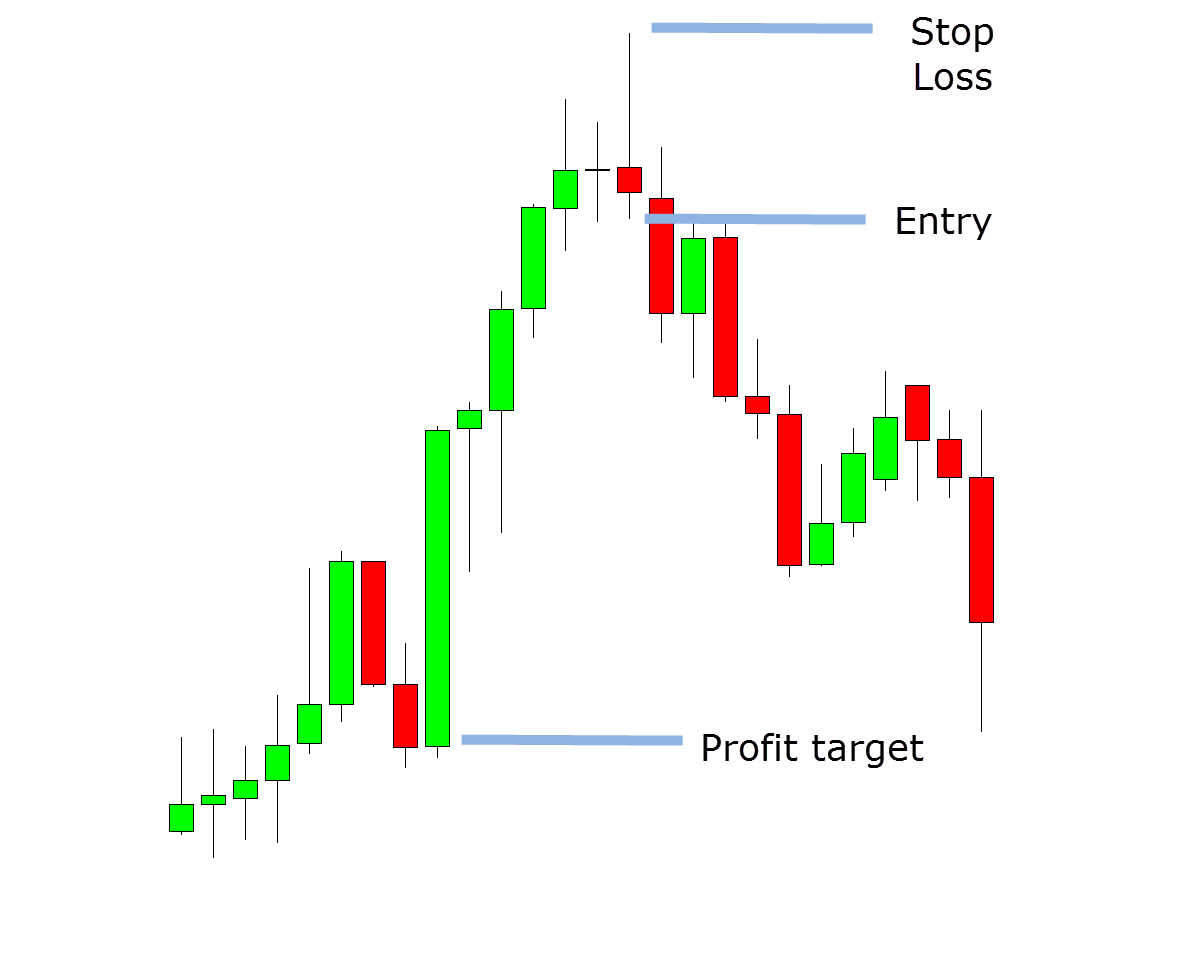

What is the best way to trade the shooting star candlestick pattern?īefore trading with the shooting star, keep the following considerations in mind: The uptrend will remain intact if the price continues to rise, and traders should favor long positions overselling or shorting. If the price rises following a shooting star, the shooting star's price range may still operate as resistance.įor instance, the price may settle around the vicinity of the shooting star. Traders may decide to sell or sell short. The candle that follows the shooting star should ideally gap lower or open around the previous close and then go lower on significant volume.Īfter a shooting star, a down day confirms the price reversal and suggests the price may continue to decrease. The next candle's high must remain below the shooting star's high, and it must then close below the shooting star's close. The shooting star candle is confirmed by the candle that forms following the shooting star. The buyers who bought during the period but are now in a losing position since the price has dropped back to the open are represented by the extended upper shadow. This indicates that towards the end of the period, buyers had lost control and sellers were gaining control. However, as the time proceeds, sellers enter the market and drive the price back down to near the open, wiping out the period's gains. This reflects the same level of buying pressure as in previous periods. Shooting stars imply a price top and reversal could be approaching.Īfter a period of three or more consecutive rising candles with higher highs, the shooting star candle is most useful.Įven if a few recent candles were bearish, it could occur within a period of generally rising prices.Ī shooting star appears after the advance and rises dramatically during the time period. Psychology behind shooting star candlestick pattern If the price rises following a shooting star, the formation could have been a false indication, or the candle could be indicating a potential resistance area in the candle's price range.

They may sell or short if the price falls during the next term. The formation is bearish since the price attempted a substantial climb during the day, but sellers took control and pulled the price back down toward the open.Īfter a shooting star, traders usually wait to observe what the next candle (period) does. It appears after a period of upward movement.Ī shooting star, to put it another way, is a type of candlestick that occurs when a security opens, advances significantly, and then finishes the day near the open.Ī shooting star candlestick must appear during a price gain to be labeled a shooting star.įurthermore, the distance between the day/period's highest price and the opening price must be more than twice the size of the shooting star's body.īelow the genuine body, there should be little to no shadow.Īfter an advance, a shooting star appears, indicating that the price may begin to plummet. What is Shooting Star Candlestick Pattern?Ī bearish candlestick with a long upper shadow, little or no lower shadow, and a little true body at the period's low is known as a shooting star. Isn't a star approaching the earth's surface?īut what does this have to do with Technical Analysis?Ī shooting star, on the other hand, is a bearish candlestick pattern with a long upper shadow and no bottom shadow. When you hear the term "Shooting Star," what is the first thing that springs to mind?

Shooting Star Candlestick Pattern- Everthing you need to know

0 kommentar(er)

0 kommentar(er)